Mid-Market Rent

Below you can find the answers to some of the most frequently asked questions around mid-market rent. You will also be able to see any immediately available homes listed via our Immedately available MMR homes section below.

Below you can find the answers to some of the most frequently asked questions around mid-market rent. You will also be able to see any immediately available homes listed via our Immedately available MMR homes section below.

Mid market rent (or MMR) is an initiative from the Scottish Government to provide quality, affordable homes for low to moderate income households. MMR tenants are typically those who would not qualify for social housing but cannot afford to pay market rent or buy a property.

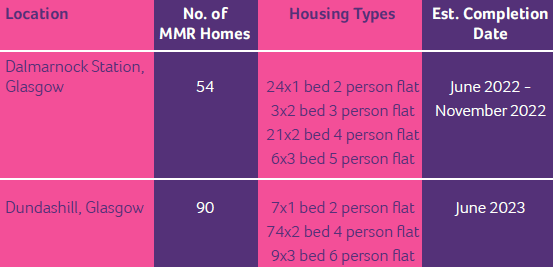

Westscot Living, a subsidiary of West of Scotland Housing Association, will manage our planned mid market properties. Details of our planned upcoming developments are as follows:

If you meet the Income Criteria your application will then be assessed further by the agreed priority Criteria. Further details on any priority criteria will be sent to all interested applicants prior to completing the application form.

Yes, one monthly rent payment in advance will be required prior to taking entry. This means that you will be paying your first months rent before you move in.

Applicants will be expected to pay the equivalent of one and a half month’s rent charge as a deposit in addition to their first month’s rent in advance. For each pet the applicant has, such as cats or dogs, the applicant will be required to pay an additional £100 deposit.

The Housing (Scotland) Act 2006 made provision for the implementation of a Tenancy Deposit Scheme in Scotland and in March 2011. The Tenancy Deposit Schemes (Scotland) Regulations 2011 came into force which places a duty on landlords, who receive a deposit in connection with a tenancy, to protect this deposit with an independent third party. From 2 July 2012 landlords are required by law to protect this deposit by transferring the funds to the Approved Scheme.

The rent that will be set will be in line with the Local Housing Allowance (LHA).

|

Property size

|

Proposed rent (£)(annual / monthly)

|

|

1 bed |

£8317.40 / £693.12 |

|

2 bed |

£10,172.24/ £847.69 |

|

3 bed |

£11,607.96/ £967.33 |

Rents will be reviewed annually and, after the first year, other charges associated with the management and maintenance of the development may be charged. Tenants will be given 3 months’ notice of any changes to your rent and/or other charges.

You will have a Private Residential Tenancy.

The Private Residential Tenancy (PRT) was introduced by the Scottish Government as the standard tenancy agreement for private residential tenancies created on or after 1st December 2017.

The purpose of the PRT is to improve security, stability and predictability for tenants and provide safeguards for landlords. PRT tenancies are open-ended, meaning no initial fixed-term.

The process for ending tenancies has been simplified; tenants are required to give 28 days’ notice regardless of how long they have been in the property.

All homes have been finished to a high standard. It is your responsibility to maintain the décor to the standard that it is let to you.

You will not be allowed to paint and/or wallpaper the walls or change the flooring. You can accessorise the flats by putting pictures on the walls, hang your own curtains etc.

The homes are let as unfurnished; they have been fitted with white goods including a tall fridge freezer, a washing machine, a cooker and shower. A good quality vinyl will be provided in hall, kitchen and kitchen/living if open plan and bathroom. All bedrooms will be fitted with carpets and all windows will have been fitted will blinds.

Only the items provided by Westscot Living will be insured. It is your responsibility to protect your belongings and therefore we would strongly recommend that you insure your belongings.

Westscot Living, as landlord of your property, is responsible for the ongoing maintenance. Full details of our and your repairs responsibilities will be issued to you as part of the allocation process..

You must apply for permission to keep a pet. You will have to pay an additonal £100 deposit for prospective tenants who have pets. This is common practice in the private rented sector.

You will be invited to view a show home once your application has been fully assessed and an offer letter has been issued. This will give you the chance to view the show home before signing an agreement.

We are currently not accepting any further applications for our MMR homes. When homes become available they will be advertised here and across Westscot Living's social media Please check back regularly to be sure you don't miss out.

If you have already submitted an application, you will remain on our list for available homes provided your application meets the eligibility criteria detailed above.

If we have any homes available for immediate entry they will be advertised here.

Our homes in Dalmarnock were launched in 2022, including 54 mid-market rent homes which range in size from 1 to 5 bedrooms, including wheelchair adaptable homes.

You can view more details on specific plots in our Dalmarnock MMR homes brochure.

I May 2024 Westscot Living launched 90 new mid market rent flats at Dundashill. The homes are created to Passivhaus standard and are a mix of 1 to 3 bedroom flats, including wheelchair adaptable, with high quality landscaping, urban play area and stunning views over the city.

You can view more details on specific plots in our Dundashill MMR homes brochure.